More Than Just a Score Library

Cascade Mortgage Automation

Our Solutions

Resources Library

TriChek Tri Merge

Move them one step closer to their dream

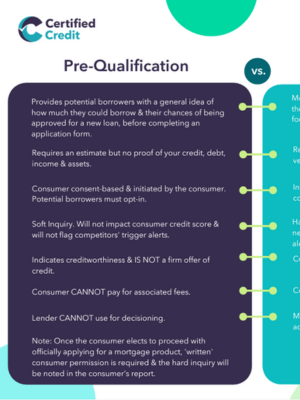

QwikChek is the go-to solution for prequalifying prospects in less time and for less money. Incorporating information from one, two or all three bureaus, this soft pull report helps you say yes with confidence and quickly turn leads into clients.

Offers Maximum Flexibility

Choose from a low-cost single bureau option or a two or three bureau merged file, all with no credit impact.

Boost Approval Rates

Instant results help you say yes faster and match your applicants to the loan option that's right for them.

Improves Efficiency

Hassle-free integration seamlessly incorporates the information into your existing LOS and workflow to speed the approval process.

Enhances Decision Making

Full bureau file gives you a complete picture of your prospective borrower's credit history, leading to better decisions and reduced risk.

Saves Time & Money

Pre-qualification enables you to affordably identify potential issues up front before the application process begins.

Reduces Fall Out

Eliminates triggers to help prevent you from losing potential borrowers to competitors.

Mortgage Only

Move them one step closer to their dream

QwikChek is the go-to solution for prequalifying prospects in less time and for less money. Incorporating information from one, two or all three bureaus, this soft pull report helps you say yes with confidence and quickly turn leads into clients.

Offers Maximum Flexibility

Choose from a low-cost single bureau option or a two or three bureau merged file, all with no credit impact.

Boost Approval Rates

Instant results help you say yes faster and match your applicants to the loan option that's right for them.

Improves Efficiency

Hassle-free integration seamlessly incorporates the information into your existing LOS and workflow to speed the approval process.

Enhances Decision Making

Full bureau file gives you a complete picture of your prospective borrower's credit history, leading to better decisions and reduced risk.

Saves Time & Money

Pre-qualification enables you to affordably identify potential issues up front before the application process begins.

Reduces Fall Out

Eliminates triggers to help prevent you from losing potential borrowers to competitors.