With available housing inventory at historically low levels and mortgage rate increases looming on the horizon, competition for housing is fierce in many markets across the United States. Wanting to buy their dream home before they get priced out of the market, many individuals and families are choosing now to shop for a new home. This seller’s market creates a unique opportunity for lenders to attract borrowers by offering a prequalification that will give their offer an edge over the competition.

Table of Contents

What is a Mortgage Prequalification?

A prequalification is an early step in the lending process that provides borrowers with an estimate of how much financing they may qualify for and what financing options may be available to them. Lenders may ask the borrower to provide information such as bank account balances, loan payments, and recent paycheck amounts. Using this data, the lender can quickly determine how much they can lend to the borrower.

In addition to the information provided by the borrower, a lender will perform a soft pull credit check. This type of credit check has the advantage of giving the lender a snapshot of the borrower’s credit without affecting their credit score or incurring the full cost of a hard inquiry.

The information they gain from a soft pull closely mirrors the information they will see on the tri-merge credit report, including the applicant’s credit score, financial history, and bankruptcy reports.

Why Should Lenders Offer Prequalifications?

In a competitive real estate market, many sellers are receiving multiple offers for their homes, and potential buyers are seeking ways to make their offers stand out above the crowd. While a cash offer is certainly appealing to sellers, most homeowners do not have the ability to offer all cash. According to a 2018 statistic from the National Association of Realtors (NAR), 88% of homebuyers finance their home purchase.1

A prequalification letter from a reputable lender can help buyers strengthen their offer by assuring the seller that the buyer has the means to qualify for a loan to back their offer. While a prequalification is not a guarantee of financing, it is a reasonable certification from a lender that a buyer is creditworthy and can afford the property they are trying to purchase based on the information provided by the borrower and a soft pull credit report.

How Do Lenders Benefit From Using a Prequalification?

While buyers seek out a prequalification as a tool to strengthen their offer on a property, the benefits of using a prequalification realized by the lender are significant as well.

● Boosts Loan Approval Rates – A prequalification soft pull is a front-line tool mortgage lenders can use to get an idea of whether or not a borrower is going to be a good candidate for a loan. Red flags on a prequalification can indicate that a lender should not proceed with a full mortgage application for a borrower or a hard credit inquiry until the borrower resolves existing credit problems. Applicants with a strong prequalification can move forward confidently, knowing they will likely be approved.

● Cuts Costs – A tri-merge credit report involves gathering trended data from multiple credit reporting sources, which can be costly. Alternatively, a prequalification creates a credit snapshot starting with the data from a single credit reporting bureau, costing the lender much less per report. Any problems that appear on a prequalification can be addressed with the borrower before any costs for appraisals, inspections, or underwriting are incurred.

● Saves Time – A soft-pull prequalification can be run same-day on a lender’s loan origination system. The ease and convenience of running these reports allow lenders to access information quickly and provide a prequalification letter to borrowers, who can then write up a competitive offer with their realtor.

● Improves Decision-Making – Accurate information is crucial to identifying qualified borrowers. The depth and breadth of prequalification are limited compared to a hard inquiry. However, key information reported in a soft-pull can assist lenders in determining which applicants are credit-worthy before either party becomes deeply vested in the loan approval process.

How Can Prequalification be a Marketing Tool for Lenders?

Many borrowers are leery of having their credit pulled to get preapproved for a loan, as they believe a mortgage inquiry will lower their credit score. While consumer credit scores can be affected by multiple hard inquiries in a short period of time, a prequalification offers access to crucial credit data through a soft pull that will not affect their credit score.

Lenders who advertise their ability to help potential homebuyers determine how much they can afford to spend on a house and strengthen their offer are likely to draw in more potential clients. After all, your prequalification letter could make the difference between an accepted offer and a rejected one.

A mortgage prequalification is a mutually beneficial tool for both borrowers and lenders. A prequalification allows both parties to gather important information about the likelihood of a loan proceeding smoothly to closing. Not only does it help in the lending process, but it can be a useful advertising tool for mortgage lenders to garner more business.

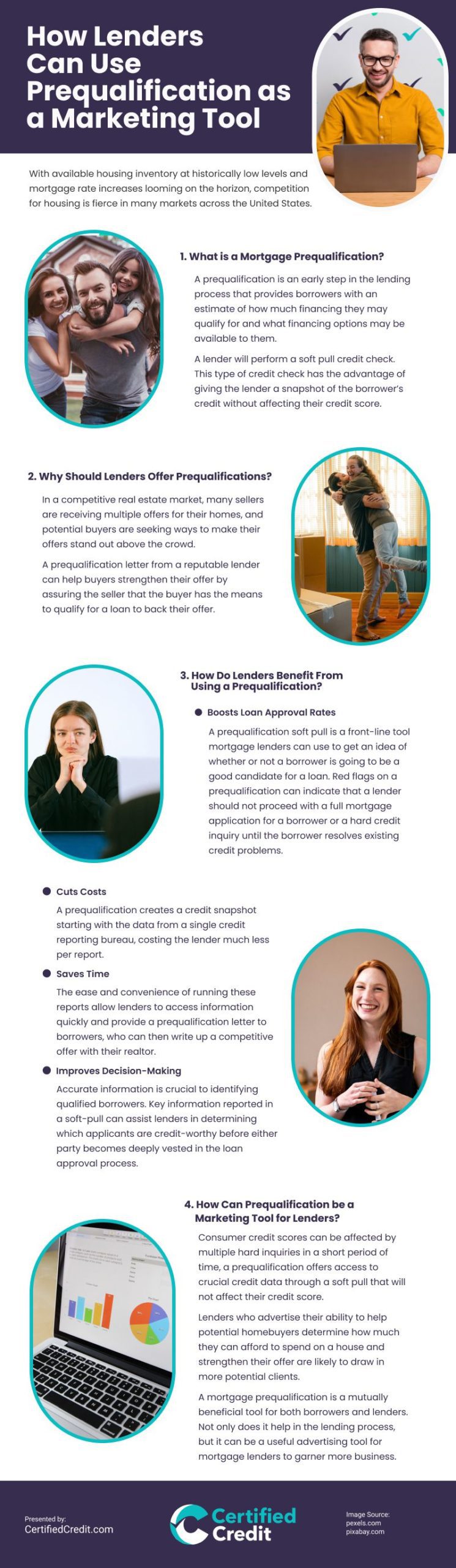

Infographic

The housing inventory in the United States is at an all-time low. In addition, the mortgage rate increase is looming. This situation creates fierce competition between people who want to purchase their dream home before it gets priced out of the market. Sellers are receiving many offers for their property. To stand out from the competition, consider getting a prequalification. Here’s what it is and what you can benefit from it.

Video

Sources:

1. Home buyers and sellers generational trends. www.nar.realtor. (2021, November 11). Retrieved March 14, 2022, from https://www.nar.realtor/research-and-statistics/research-reports/home-buyer-and-seller-generational-trends