When it comes to mortgage lending, tri-merge credit reports are the gold standard.[i] These comprehensive credit reports combine credit data from all three of the major credit bureaus: TransUnion, Equifax, and Experian.

By offering a more complete picture of a borrower’s credit history, tri-merge credit reports can enhance mortgage lenders’ and underwriters’ confidence in their lending decisions.

So, how can you read a credit report and what is the importance of a tri-merge report? In this article, we’ll break down the process step-by-step.

#1 Make Sure That YourBorrower’s Information Is Correct

When ordering a tri-merge credit report, there’s always a slight possibility that you may make a mistake while typing in your borrower’s information. For example, you may misspell their name or input their Social Security number improperly.

The last thing you want to do is make a lending decision based on the wrong person’s information. Thus, the first step to reading a tri-merge credit report is verifying the borrower’s details. You can do so by double-checking that the name, address, Social Security number, and birth date match your records.

To prevent these types of mistakes going forward, you can also take advantage of Certified Credit’s Flex ID Smart Select Shield. This tool can:

-

-

- Verify borrowers’ information before you submit your tri-merge order – Tri-merge credit reports aren’t cheap. In turn, you probably don’t want to order credit reports for the wrong borrowers if you can avoid it.

-

Flex ID Smart Select Shield can verify your borrower’s information in real time as you type it in, giving you more peace of mind that you’re ordering the right report.

-

-

- Protect your business against fraud – While an inaccurate credit report may be due to unintentional typing errors, sometimes there’s a more nefarious explanation: mortgage fraud.Desperate borrowers may misrepresent their identification information to increase their chances of qualifying for a mortgage. Luckily, Flex ID Smart Select Shield can suss out this type of fraud before you submit your tri-merge credit report order, saving you time and protecting your business against mortgage fraud.

- Save you the expense of ordering tri-merges for applicants who don’t meet your basic criteria – Lastly, Flex ID Smart Select Shield allows you to set certain credit conditions that must be met before a tri-merge credit report is ordered. By pulling an initial soft-pull on the credit report, you can verify that the borrower will qualify for one or more loan products. If they aren’t met, you can rest assured that you won’t waste money on a tri-merge credit report for a borrower that doesn’t meet your basic conditions.

-

#2 Review Your Borrower’s Tradeline Liability

Once you’ve received a credit report and made sure the borrower is correct, you can start analyzing their tradeline information.

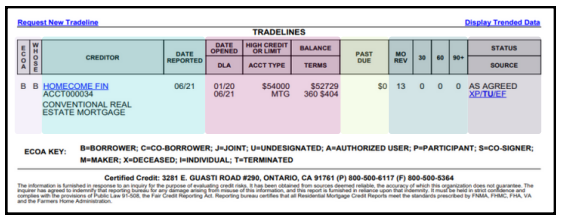

The first column within a credit report outlines each tradeline’s Equal Credit Opportunity Act (ECOA) and Whose codes:

-

-

- ECOA column (Light Purple in Example) – The ECOA column indicates who is liable for each tradeline listed within the tri-merge credit report. It does so using alphabetical symbols. The meaning of these symbols is as follows:

- B: Individual Account belonging to the borrower

- I: Individual Account belonging solely to the borrower, but rarely used

- C: Individual Account belonging to the co-borrower

- J: Joint Account that both borrowers are contractually liable for

- U: Undesignated, meaning that liability has not yet been established

- A: Authorized User with no contractual responsibility

- P: Participant in a Shared Account whose contractual liability is still undetermined

- M: Maker, who is a borrower who is primarily responsible for an account that has a co-signer

- S: Shared Account where the borrower is a co-signer with joint liability and may become liable if the primary maker defaults on their payments

- X: The borrower is deceased

- T: Terminated, meaning the borrower is no longer associated with a joint or co-signed account.

- Whose Column (Light Purple in Example) – The Whose Column lets you know whose credit report originally provided the information obtained. Like the ECOA column, it does so using the following alphabetical symbols:

- B: The information only appears within this borrower’s credit report.

- C: The information only appears within their co-borrower’s credit report.

- J: The information appears within both borrowers’ credit reports.

- ECOA column (Light Purple in Example) – The ECOA column indicates who is liable for each tradeline listed within the tri-merge credit report. It does so using alphabetical symbols. The meaning of these symbols is as follows:

-

Since this section includes some of the most important elements of an applicant’s credit history, you may want to encourage your applicants to review this section carefully on their own to ensure it’s error-free.

#3 Take a Look at Each Tradeline’s Creditor and Report Date

Next, you can look to the second column to learn about each tradeline’s creditor and report date.

The Creditor column lists (Light Blue in Example) out each tradeline’s:

-

-

- Creditor name

- Account number

- Late dates (if the borrower has any delinquencies)

-

Meanwhile, the Date Reported column simply states the last time this creditor reported this account to the credit bureau. It can give you an idea of how up-to-date its tradeline information is.

#4 Dig Into Each Tradeline’s Details

The purpose of credit reports is to learn about borrowers’ credit management habits. You probably want to know the types of credit accounts they have experience using, how much they owe on each account, and whether they max out their credit limits or keep their spending in check.

You can find the answers to these questions in a credit report’s Trade Details column (Magenta in Example). It includes the following information:

-

-

- Date Opened – This is the date that the borrower opened the account.

- DLA – DLA stands for “date of last activity” on the account.

- High Credit or Limit – This section lets you know either the highest amount that was borrowed using this account or the credit limit if it’s a charge account.

- Acct Type – The account type denotes the type of credit account. The options include:

- MTG: Mortgage

-

-

-

- INST: Installment Account

- AUTO: Auto Loan

- CRCD: Credit Card

- COLL: Account in Collections

- REV: Revolving Account

- OPEN: Open Account

- EDU: Education Account

- COSI: Co-signer Account

- LEAS: Leasing Account

-

-

-

- Balance – This section shows the outstanding balance at the time that the account was last reported to the credit bureau.

- Terms – The Terms section contains two numbers. The first number indicates the number of months in the loan term, while the second number states the monthly payment amount.

-

This is another section that consumers should review diligently for errors before they submit their mortgage applications. Some common errors can include:

-

-

- Account names or account numbers are incorrect

- The same account is listed under multiple creditors (often indicating it’s in collections)

- Credit limits or loan sizes are incorrect

- Balance sizes are incorrect

- Payment due dates or payment statuses are incorrect

- Dates for when an account was opened, closed, or paid are wrong

- Closed accounts are reported as open

- Open accounts or closed accounts in good standing are inaccurately reported as delinquent

-

These types of issues may be simple mistakes, but they can also be potential signs of identity fraud. If your applicant discovers any of these issues, they should file a dispute with the credit bureau that reported the inaccurate information right away. We provide detailed instructions for filing a dispute later in this article.

#5 Find Out If Any Payments Are Past Due

Another crucial piece of information you’ll want to know about your applicants is whether or not they make their debt payments on time.

Past behavior is one of the best predictors of future behavior, so if an applicant has a long list of late payments, they may be less likely to pay you back on time too.

You can learn about an applicant’s payment history in the Past Due column (Yellow in Example). It lets you know which tradelines have payments that are past due and the value of these outstanding payments.

Educate Your Borrowers About The Importance of Payment History

Many credit consumers don’t understand what factors make up their credit scores. Thus, you may want to share some educational material with them explaining that:

-

-

- Payment history makes up 35% of consumers’ FICO credit scores.

-

-

-

- Payment history is more influential than any other factor.

- Late payments can stick around on credit reports for up to seven years.

- Payments aren’t reported as late to the credit bureaus until they’re 30 days past due, though these missed payments may still result in late fees.

- The impact of late payments depends on how late, how large, how frequent, and how recent they are.

-

#6 Analyze The MO REV and 30/60/90+ Grid

You can gain even more insight into an applicant’s payment habits by checking out the MO REV and 30/60/90+ columns (Green in Example). They lay out the following information:

-

-

- MO REV – MO REV, a.k.a Months Reviewed, indicates how many months an account has been reported to the credit bureaus since it was opened.

- 30/60/90+ Grid – The 30/60/90+ Grid lets you know how many times the account has been 30, 60, or 90+ days past due. Naturally, if you notice high numbers in this section, you may want to reconsider approving an applicant.

-

#7 Scrutinize the Tradeline’sStatus and Source

The last column within tri-merge credit reports conveys the current status of the credit account, as well as which credit bureaus are reporting this information. The credit bureau shown in bold indicates which copy of the tradeline information you’re viewing. You can switch to another credit bureau’s tradeline details by clicking on its hyperlink.

Some source codes you may come across in this column (Grey in Example) include:

-

-

- NO STATUS: No status provided.

- CRCDLOST: The credit card has been lost.

- INACTIVE: The account is inactive.

- DELETED: The account was deleted from the credit report by the credit agency.

- AS AGREED: The account is current and paid as agreed.

- CUR WAS (30/60/90/120/COLL/REPO/BK/FORE): The account was delinquent in the past but now it’s current.

- PAID: The account was closed and paid off.

- CLOSED: The account was closed.

- TRANSFERRED: The account was transferred.

- PD WAS (30/60/90/120+): The account was previously delinquent but is now paid and closed.

- DELINQ (30/60/90/120+): The account is currently delinquent.

- BANKRUPTCY: The account was included in bankruptcy.

- PAY PLAN: The account is being paid under a payment plan.

- REPOSESS: The account led to a repossession.

- FORECLOS: The account led to foreclosure.

- SETTLED: The account was settled.

- VOL SUR: The account was voluntarily surrendered.

- CHARGE OFF: The account was charged off.

- COLLECTION: The account has been placed in collections.

- PD WAS (COLL/REPO/CHG OFF/FORCLO): The account paid was delinquent as shown.

- CO NOW PAY: The account was charged off and is now being paid.

- GOV CLAIM: A claim was filed with the government for the insured portion of the loan balance.

- CLOS NP AA: The account was closed, but it wasn’t paid as agreed.

- SCNL: The account was skipped and the consumer can’t be located.

-

While these codes can look a little complicated, they communicate critical information about your applicant’s credit management and neatly summarize their derogatory marks. Depending on your investors’ guidelines, you may need to have your applicant pay off their derogatory accounts before you can approve their application.

Can’t remember all of the codes? We have you covered with our downloadable “Quick Reference: How to Read a Credit Report Guide”.

#8 Find Out If Your Applicant Wants to Make Any Disputes

Tri-merge credit reports offer the most complete picture of an applicant’s creditworthiness. However, they have to contain accurate information to paint an accurate picture.

Thus, you may want to teach your applicants how they can file disputes with the credit bureaus to fix any inaccuracies before they start shopping for a mortgage. Disputes can be filed online, over the phone, or by mail.

Let your applicants know that they’ll need to provide documentation to back up their claims that certain reporting information is incorrect. They’ll also need to include proof of identity in the form of their Social Security number, birth date, and copy of their ID.

The process for disputing credit reporting errors with each of the credit bureaus is as follows:

-

-

- Equifax:

- File the dispute online here.

- File it over the phone by calling (866) 349-5191.

- Send it by mail to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374-0256.

- Experian:

- File the dispute online here.

- File it over the phone using the number for Experian shown in your credit report.

- Mail it to Experian, P.O. Box 4500, Allen, TX 75013.

- TransUnion:

- File the dispute online here.

- File it over the phone by calling (800) 916-8800.

- Mail it to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016-2000.

- Equifax:

-

#9 Check The FICO Score Indicator

Finally, you can review your applicants’ mortgage credit scores within the tri-merge credit report. The score shown will be the middle score of the three credit bureau’s scores.[ii]

Certified Credit: Affordable Tri-Merge Credit Reports And Other Lending Solutions

As you can see, tri-merge credit reports provide mortgage lenders with a wealth of information about their applicants. Now that you know how to interpret this information, you can use it to inform your lending decisions.

If you’re searching for an affordable provider of tri-merge credit reports, look no further than Certified Credit. In addition to our credit reports, we also offer the following mortgage lending solutions:

- Automated borrower retention and lead generation tools

- Automated undisclosed debt monitoring

- Automated prequalification

- Automated verification of income and employment

- Credit score improvement tools

- Affordable soft pull and refresh credit reports

- Flood zone determinations

- Fraud and risk support

- Settlement services

Find out more about our innovative solutions for mortgage lenders by scheduling a credit consultation with our team today.

Sources:

[i] Rocket Mortgage. Understanding Tri-Mortgage Credit Reports: Here’s What You Should Know.

https://www.rocketmortgage.com/learn/tri-merge-credit-report

[ii] Experian. Which Credit Scores Do Mortgage Lenders Use?

https://www.experian.com/blogs/ask-experian/which-credit-scores-do-mortgage-lenders-use/